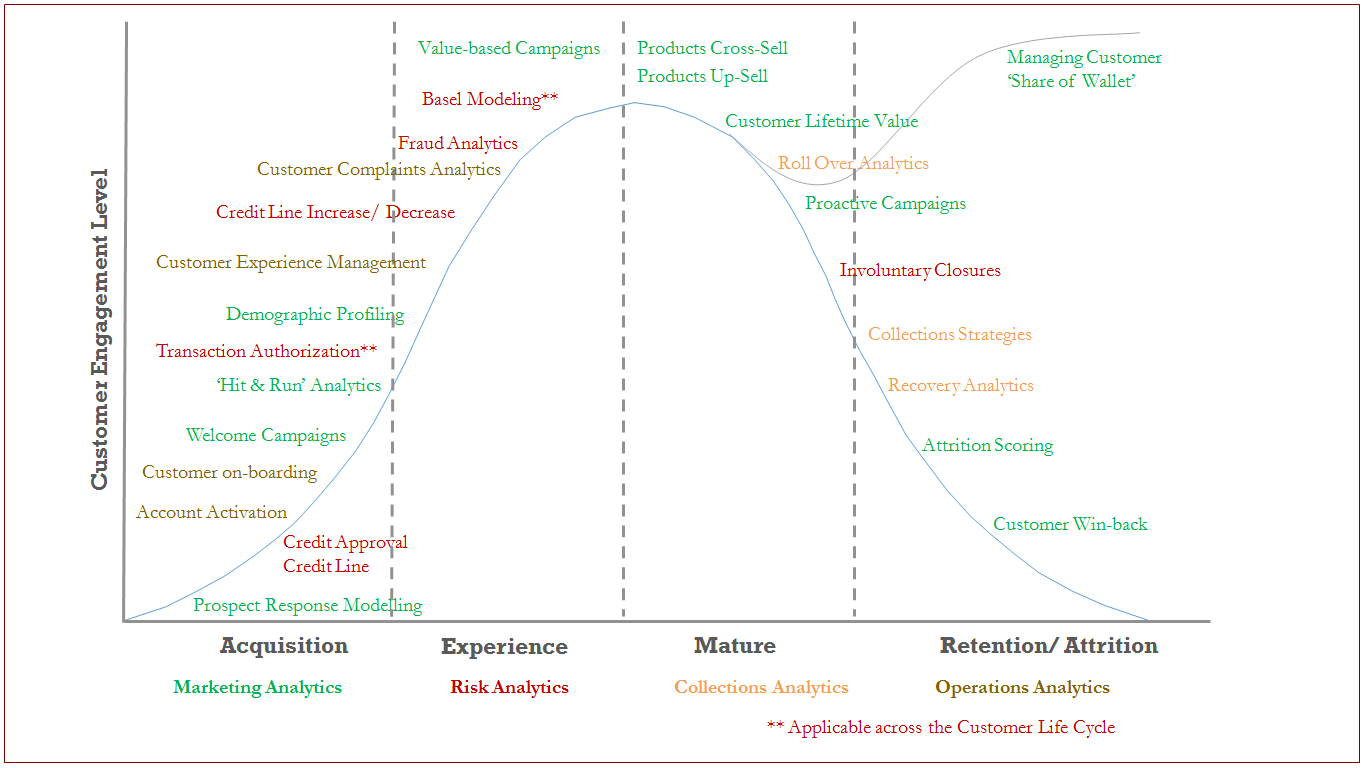

A retail bank wishes to develop a credit risk scoring model to evaluate the credit worthiness of its personal loan borrowers. Accurate prediction of the borrowers’ probability to default on their loans would allow the bank to implement a robust credit approval mechanism apart from pricing its loans in accordance with the associated risks. An effective credit appraisal and pricing mechanism would enable the bank to restrict potentially delinquent customers, thereby freeing up bandwidth and capital to increase business with good customers.

Read More

An asset-management company wants to identify customers that have a high amount of investable assets lying outside the company’s portfolio. The company also wants to arrive at an effective strategy to win such customers back. Segmentation based on assets under management, information internal to the company, and total investable assets (which can be obtained from external sources) helps to identify customer segments that provide good opportunity to run win-back campaigns. In addition, a look-alike segmentation based on profitable customers helps to target & engage high potential customers more effectively.

Read More

A retail bank wishes to grow its credit-card subscriber base by offering balance transfers to customers with competing credit-card issuers. The bank wants to identify the factors that influence the acceptability of such balance-transfer offers amongst credit-card holders. Identification of customer segments that have high propensity to respond positively to balance transfers would enable the bank to focus its acquisition campaigns on such segments, thereby controlling acquisition costs as well as growing its credit-card subscriber base. Predictive modelling and segmentation techniques are deployed to develop prospect response propensity models that allow the bank to achieve its dual objectives of growing the credit-card business as well as controlling customer acquisition costs.

Read More

A financial institution wishes to optimize the mix of new customer acquisition channels, limiting the usage of higher-cost direct-mailer channels to just those customer segments that have low conversion propensity when targeted via other relatively lower-cost channels. Segmentation techniques and predictive modelling are used to identify customer characteristics that drive high conversion propensity for direct-mailer campaigns and low propensity for other channels. The resulting customer acquisition model enables the financial institution to engage in effective prospect selection for its acquisition campaigns across the various channels. This allows the company to enhance the effectiveness of its direct-mailer campaigns as well as increase the marketing RoI for acquisition campaigns as a whole.

Read More