Summary

An asset-management company wants to identify customers that have a high amount of investable assets lying outside the company’s portfolio. The company also wants to arrive at an effective strategy to win such customers back. Segmentation based on assets under management, information internal to the company, and total investable assets (which can be obtained from external sources) helps to identify customer segments that provide good opportunity to run win-back campaigns. In addition, a look-alike segmentation based on profitable customers helps to target & engage high potential customers more effectively.

Business Backdrop

An asset-management company has recently been adversely affected by rumours in the market place that caused a lot of customers taking their money out of the portfolio being managed by the company. This resulted in a sudden drop in the company’s business. In addition, the company is struggling to gain back the confidence of their customers. To regain customer confidence, the company wants to identify existing customers that are profitable and who can also act as brand promoters for the company.

Of the various initiatives undertaken by the company in this regard, one is to segment the customer base based on their assets under management (AUM) and their total investable assets. The objective is to identify customers that continue to have most of their investable assets entrusted with the company, so as to understand their behavioural & investment patterns. Such knowledge would then be applied to those customers that keep most of their assets are invested outside the company (probably with competitors) despite having an account with the company.

Analytical Approach

The initial challenge for the project is to get the “Total Investable Assets” for a customer. Though income levels have a high correlation with this variable, such a relationship is not always true, neither is it available accurately for all customers. While opening their accounts, customers provide data on their “Total Investable Assets”, but the values filled by the customer a few years back is not likely to remain valid over time. Hence, it is required to get some external data.

Credit bureau organizations can provide individual-level loan status or financial condition status, but these can be very different from our required variable, i.e., total investable assets. Equifax, a leading credit bureau organization in the world, collects and shares such information, called IXI data. But, the data is summarized at a zip-code level, and not available at an individual level.

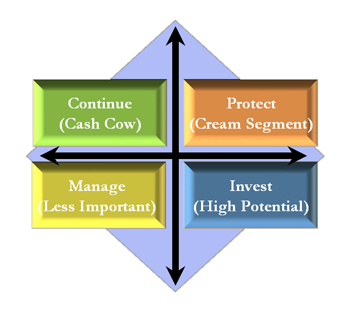

The IXI data is used, and customers are segmented into four quadrants, based on “Total Investable Assets” and “Assets Under Management”. The four quadrants can be labelled “Continue”, “Protect”, “Manage” and “Invest”. “Protect” customers are the cream segment that have high investable assets and most of them are under the company’s portfolio. On the other hand, “Invest” customers provide a good opportunity to bring their high investable assets into the company’s portfolio.

Subsequent to defining the various customer segments, exploratory analysis is done to understand the hidden behaviour of the customers. Specifically, behavioural segmentation is done on the “Protect” segment, and a look-alike segmentation exercise is repeated on “Invest” customers. Such analysis identifies the win-back opportunity for the “Invest” quadrant.

Solution Framework

- Exploratory Analysis

- Customer Profiling

- Look-alike Segmentation

Business Benefits

Equipped with such a “share-of-wallet” analysis, the company is able to effectively design customer win-back campaigns. The company can come up with a number of promotional campaigns that are likely to receive good responses from the customers.