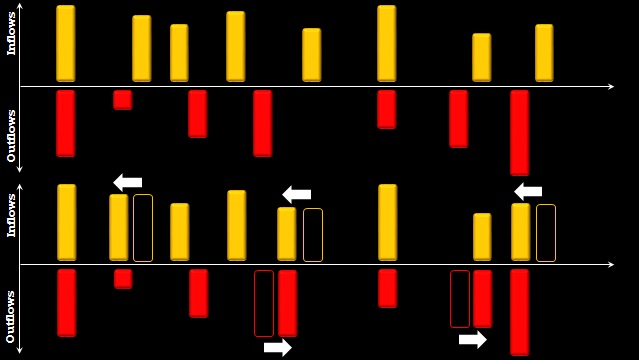

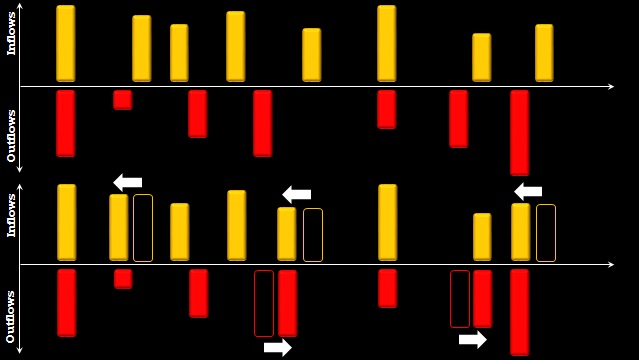

Working Capital Management is a key driver of organizations' profitability and cash flow position. Firms with robust working-capital management systems in place can better balance their cash inflows & outflows, thereby reducing external financing requirements. A key component of managing a company's cash conversion cycle is proactive management of the customer & supplier credit periods, in a manner that ensures cash inflows & outflows match-up in an optimal fashion.

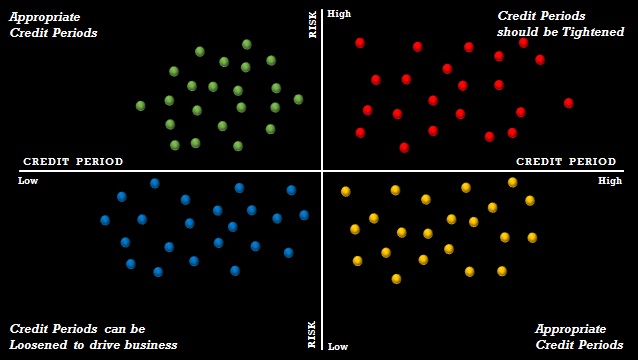

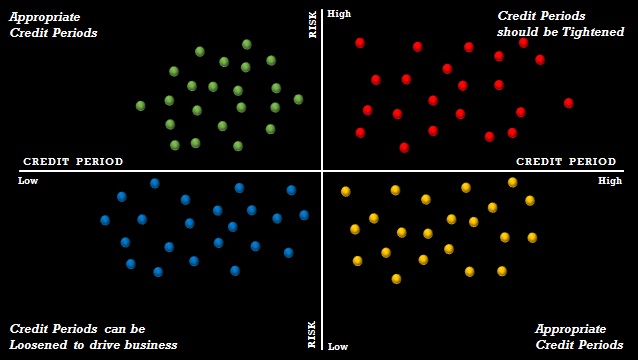

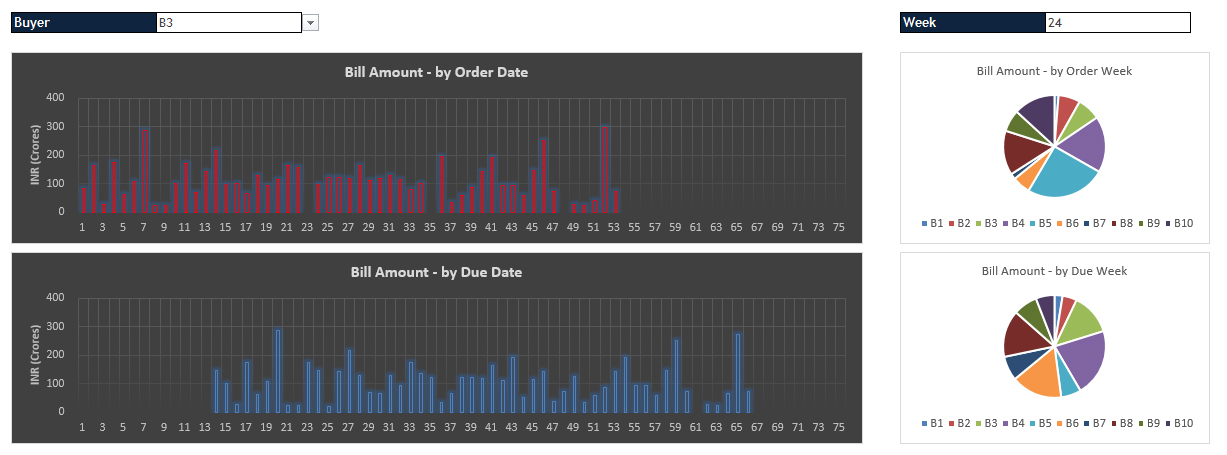

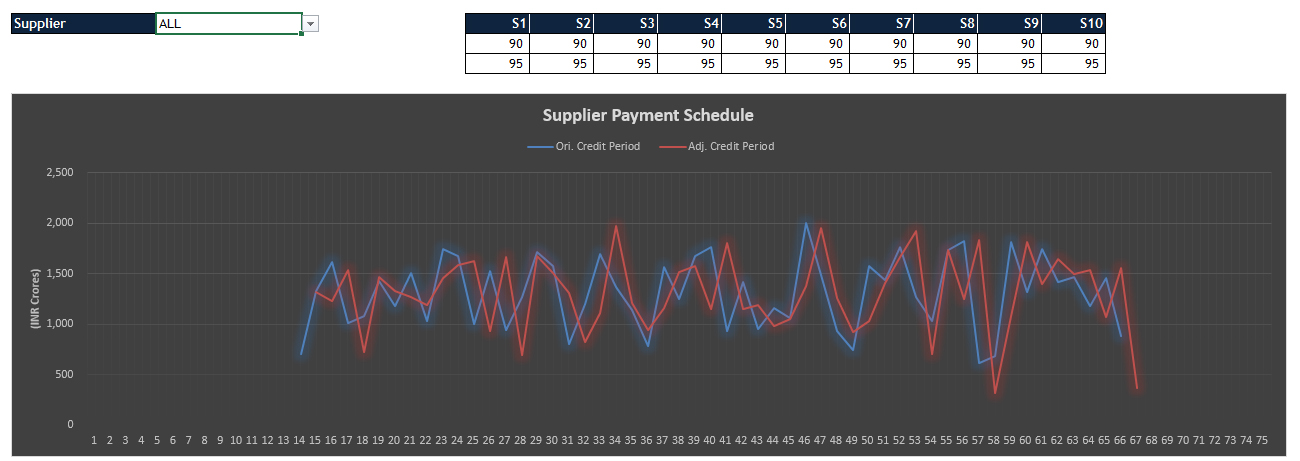

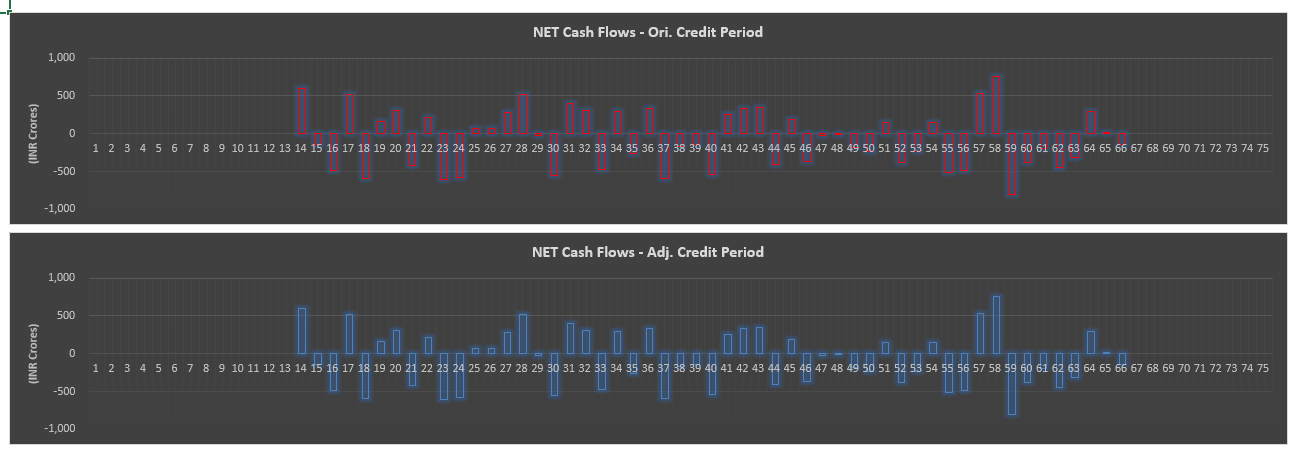

An integrated easy-to-use working-capital management solution allows a firm's business end-users to dynamically manage the credit periods for the various suppliers & vendors, as well as monitor the impact of such dynamic adjustments on net cash flows. With such a solution in place, the company also benefits from early-warning signals of potential cash shortfalls. The working-capital management solution integrates seamlessly with a risk-based customer classification solution, enabling business end-users to take credit-period adjustment decisions driven by customers' risk scores.

The solution is technology-agnostic, and available over a range of technology platforms. Choice of the best-suited platform for specific installations is governed by the existing ERP product being used by the client, in order to provide a cost-effective solution and to ensure seamless connectivity & integration. Open-source adaptations of the solution are also available to reduce the total cost of ownership for the client.