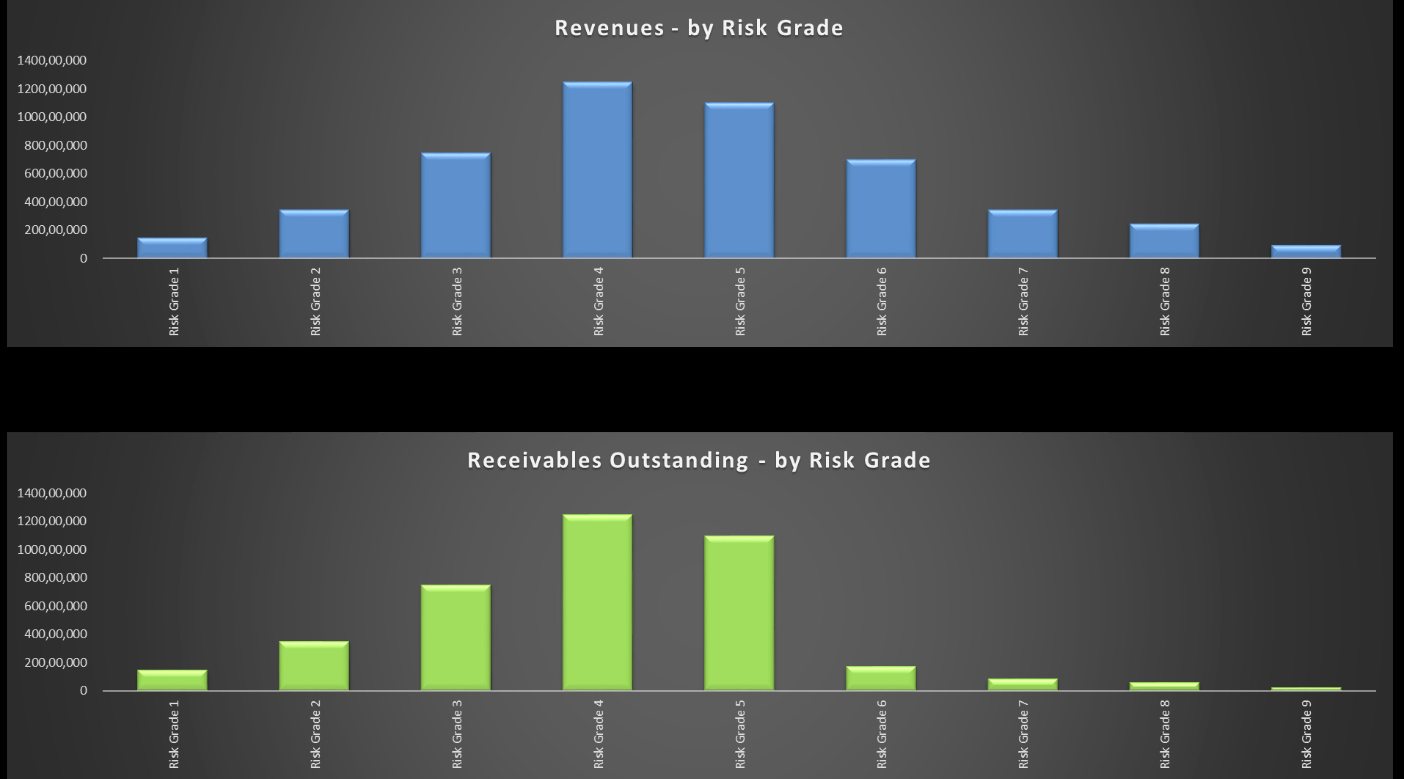

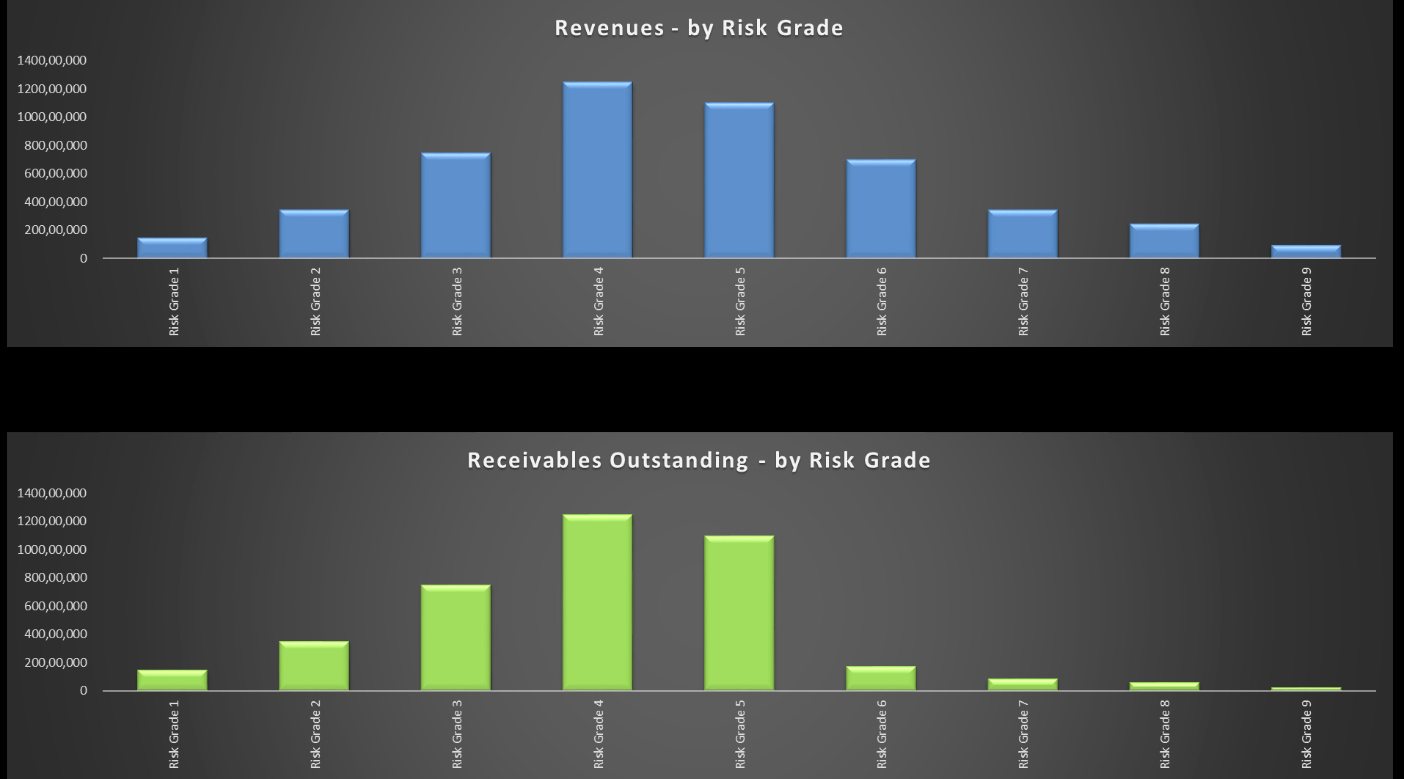

Organizations conduct their business with a wide range of customers. They sell their products & services to a diverse customer base of varying credit worthiness profiles. The ability to assess the credit risk associated with each of their customers is important in order to formulate appropriate strategies with regards to business exposure and receivables management. Firms with well-rounded risk assessment frameworks are able to tailor their business decisions keeping in mind the underlying risk profiles of their customer base.

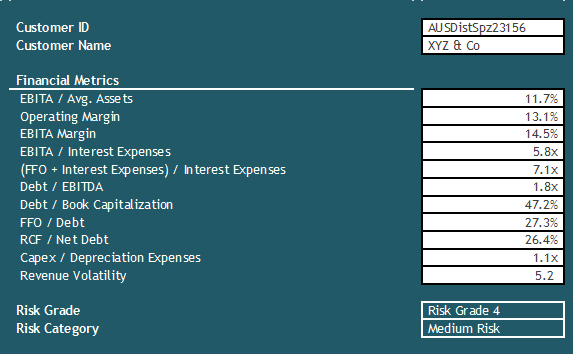

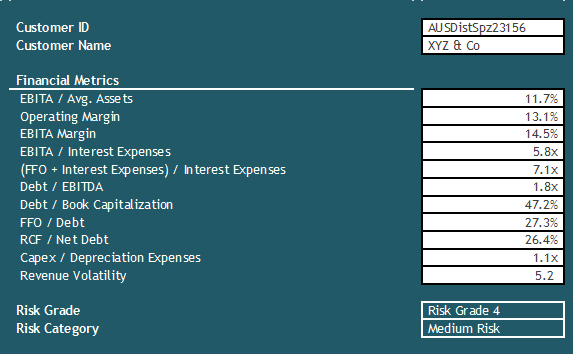

An integrated easy-to-use customer risk scoring solution allows organizations to develop robust risk management systems to govern strategic business decisions in the areas of sales strategies, credit policies, receivables management, doubtful debt reserving, collection strategies, etc. Such a customer credit worthiness scoring solution is modelled on a principle similar to that deployed by credit rating agencies, and is easily extendable to include prior receivables payment behaviour witnessed in-house.

The risk-based customer classification solution integrates seamlessly with a working-capital management solution, enabling business end-users to take credit-period adjustment decisions driven by customers' risk scores.

The solution is technology-agnostic, and available over a range of technology platforms. Choice of the best-suited platform for specific installations is governed by the existing ERP product being used by the client, in order to provide a cost-effective solution and to ensure seamless connectivity & integration. Open-source adaptations of the solution are also available to reduce the total cost of ownership for the client.