Summary

One of India’s biggest auction houses, when venturing into tea procurement and auctions, wanted to develop an analytical model to predict the auction bid-start price in order to get a competitive advantage. Using 4-year auction pricing data for a tea board, a predictive model was built using a combination of hedonic pricing analysis and auto-regressive distributed lag (ARDL) modelling, together with mixed-effects regression modelling approaches. The predictive model enabled the client to reduce its dependence on tea tasters and enhance the price-discovery effectiveness of the auction process.

Business Backdrop

The client is venturing into tea procurement & actions. Tea is auctioned, and predicting its future price is crucial for the client to succeed in its venture. At present, the tea quality and auction bid-start price are decided by tea tasters. The client wants to develop the analytical capability to predict tea prices to get a competitive advantage.

The bid-start price in tea auctions depends on quality of the tea, termed as the grade of the tea. The quality (grade) of the tea is decided by tea tasters based on their human cognitive capabilities. Depending on the quality (grade) of tea, the tea tasters also recommend the associated bid-start price.

Analytical Approach

Data for tea auctions was available for a 4-year period. The dataset provided bid-start prices for eight unique auctioneers, 742 unique sellers, and 161 unique grades of tea.

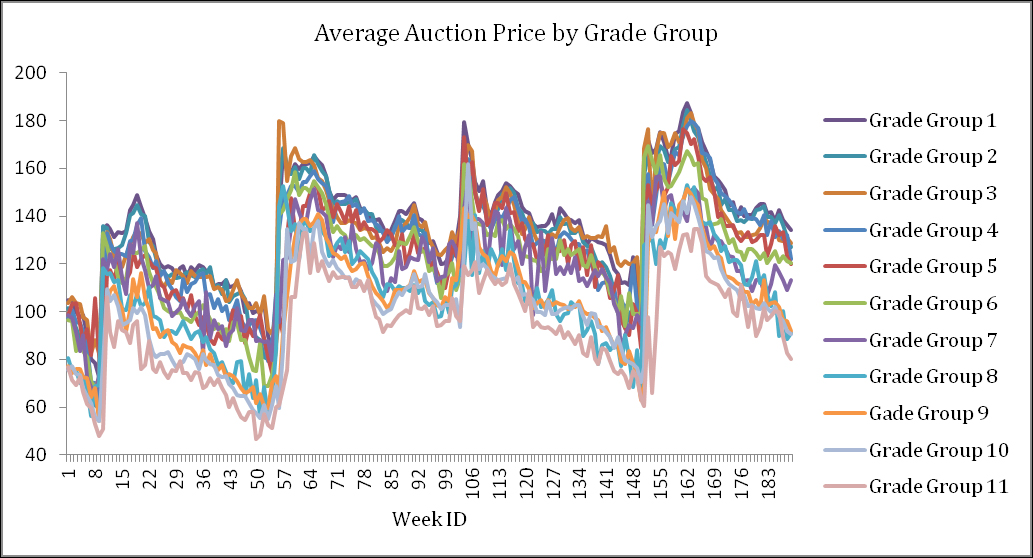

The data was neither a time-series data, nor longitudinal in nature. Accordingly, the 161 different grades of tea were grouped into 11 distinct groups. The data was then aggregated and converted to longitudinal data, so that advanced statistical modelling techniques could be applied.

Given the nature of the data, hedonic pricing analysis techniques were deployed to predict the auction price, using mixed-effects regression modelling and auto-regressive distributed lag (ARDL) modelling techniques.

Solution Framework

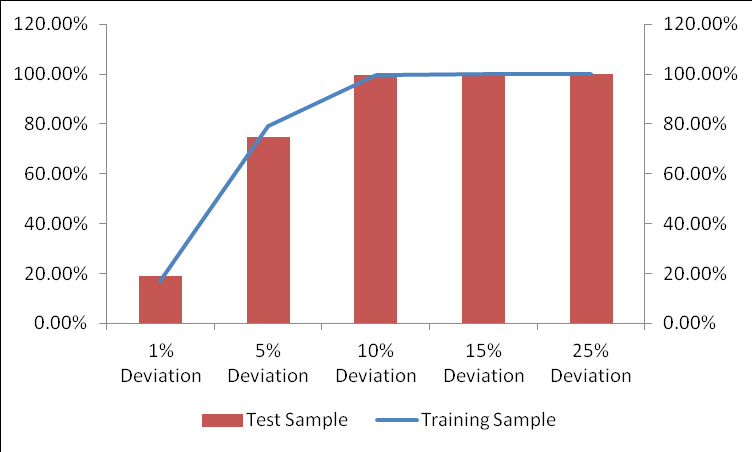

The final solution was developed based on mixed-effects regression techniques, and a combination of auto-regressive distributed lag (ARDL) models and hedonic pricing models. The model performed well with test data and validation data.

Business Benefits

With the predictive model in place, the client was able to predict the bid-start price for tea auctions. Such predictions allowed the client to reduce its dependence on tea tasters and to enhance the price-discovery effectiveness of the auction process.