Being able to project business & financial performance in an inherently uncertain environment is a key determinant of organizations' success in navigating through fluctuations in business cycles. Faced with changing market dynamics and evolving customer preferences, firms with effective & efficient projection frameworks are better-equipped to quickly arrive at critical strategic decisions with regards to capital structure and debt management.

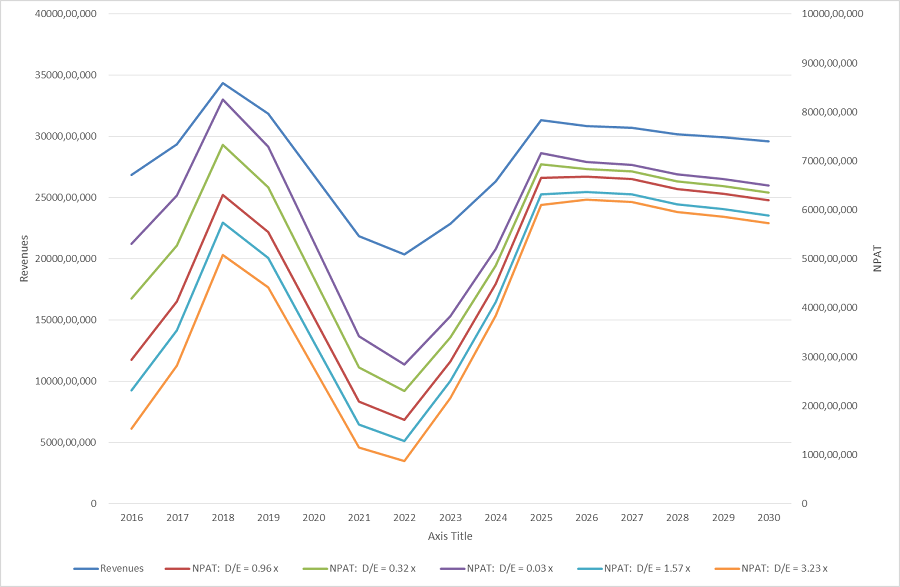

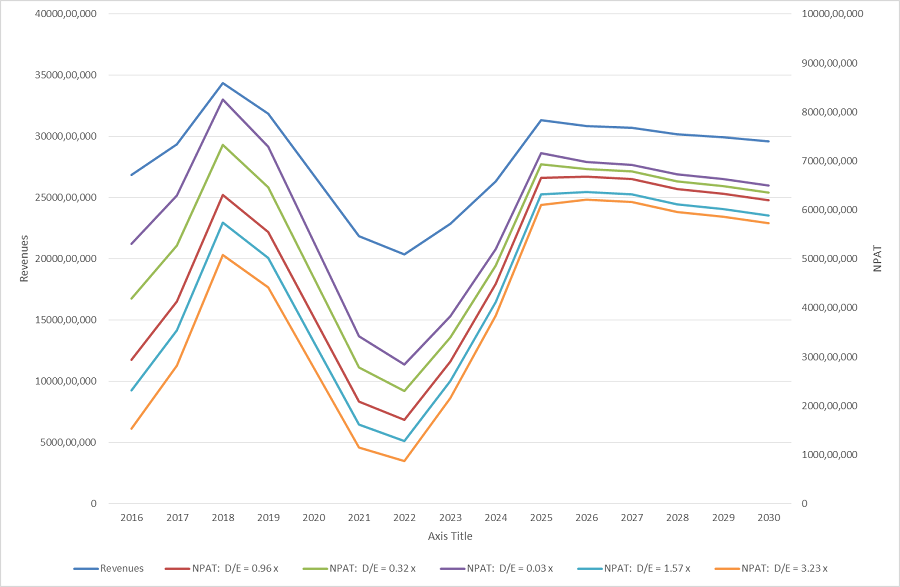

An integrated user-friendly business simulation engine allows organizations to develop robust projections of their business & financial performance that accommodate variations in the sales cycle. A versatile profitability projection solution allows firms to monitor the sensitivity of bottom-line performance to variations in the top-line. In particular, estimation of the degree of fluctuations in net profits as a result of fluctuations in revenues, and modelling of such bottom-line variations as a function of financial leverage, allows firms to optimize debt management decisions.

Armed with such leverage sensitivity information, firms are better equipped to decide the mix of short-term debt and long-term debt that is most appropriate given the stage of the business cycle the firm is about to enter.

The solution is technology-agnostic, and available over a range of technology platforms. Choice of the best-suited platform for specific installations is governed by the existing ERP product being used by the client, in order to provide a cost-effective solution and to ensure seamless connectivity & integration. Open-source adaptations of the solution are also available to reduce the total cost of ownership for the client.