In today's world, all banks are using analytics to take more informed decisions. Banks use a risk scorecard model to approve a loan, be it a secured loan (such as home loans or vehicle loans) or an unsecured loan (like credit cards or education loans). The scorecards are either developed by in-house analytics teams or purchased from external agencies (for example, credit bureau scores, etc). Often banks struggle to monitor the performance of the models. Such monitoring is done either through ad hoc reports & tracking or periodic recalibrations of the models. It is imperative that banks examine the ongoing validity (versus obsolescence) of the models during such recalibration exercises. Banks that do not possess in-house analytics expertize and use external credit scores could struggle to conduct such evaluation & validation exercises, particularly in deciding whether the scorecard remains applicable across the bank's target market segments.

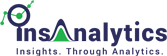

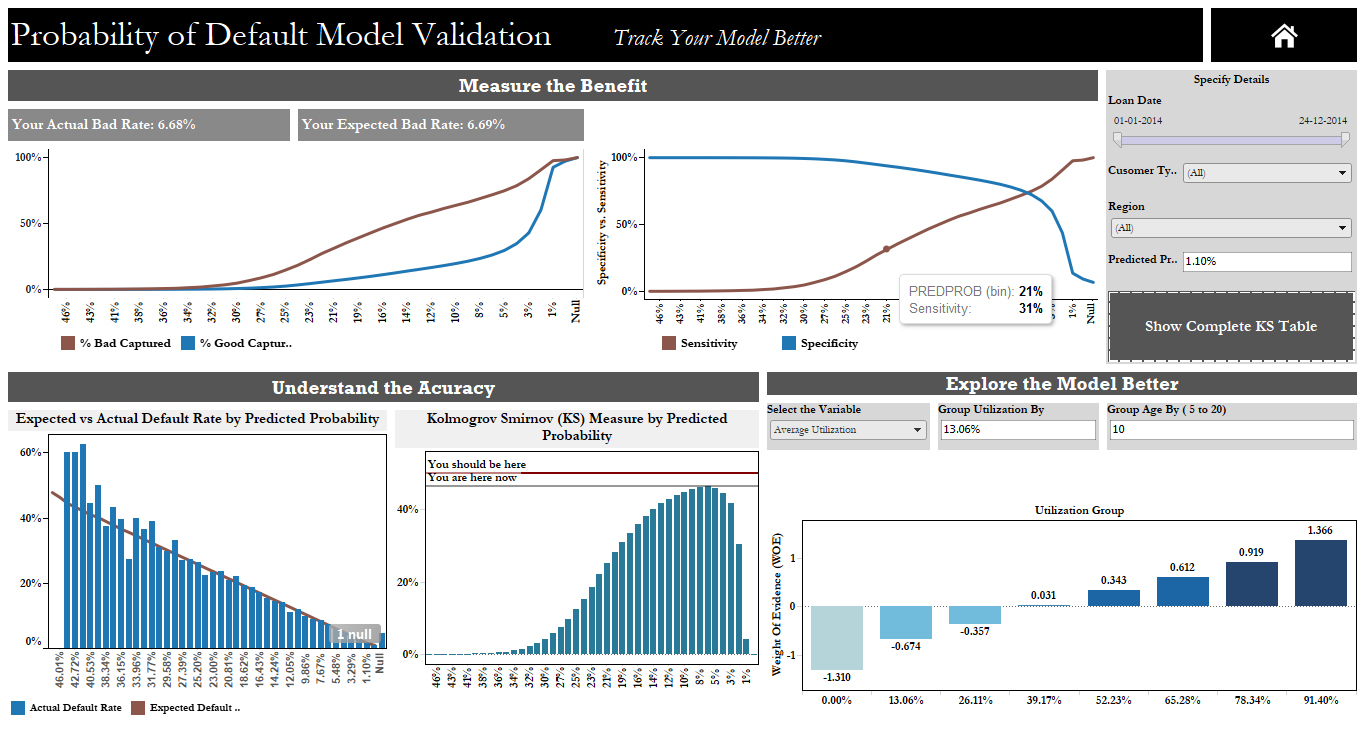

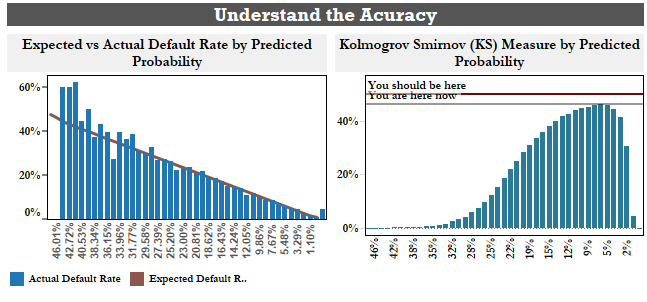

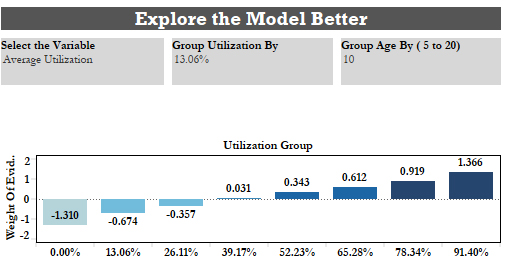

insAnalytics brings an integrated easy-to-use validation tool to track, monitor, and evaluate the scorecard being used by the bank. The solution provides answers not just to the questions generally asked by business end-users, but also those asked by project leaders and analysts. The complete solution is divided into three major sections. "Measure the Benefit" tracks major KPIs looked at by the business users. "Understand the Accuracy" reports statistical measures that help a project leader to monitor the performance of the model. "Understand Model Better" provides a 'dig-deeper' analysis that helps an analyst to evaluate areas where the model is performing in the desired fashion as well as areas that need to be investigated.

The solution is technology-agnostic, and available over a range of technology platforms. Choice of the best-suited platform for specific installations is governed by the existing ERP product being used by the client, in order to provide a cost-effective solution and to ensure seamless connectivity & integration. Open-source adaptations of the solution are also available to reduce the total cost of ownership for the client.